TVH’s ACQUISITION CRITERIA

Texas Valley Holding’s real estate division develops and acquires commercial assets strictly for its own portfolio. Property types range from multifamily, retail, land, and ground-leases. Texas Valley Holding’s current portfolio consists of approximately 250,000 square feet of income-producing properties throughout the United States. We are aggressively pursuing acquisitions focusing on the following product, markets and general acquisition parameters:

PRODUCT FOCUS

- Multi-Family

- A or B quality asset

- 20 to 50 units

- Built in 2000's or earlier

- Core or Value-add

- 6.0% - 8.0% cap rate

- Retail

- Shadow-anchored (preferred, but not required)

- A or B quality asset

- Single & multi-tenant product

- NNN lease structure

- Built in 2000’s or earlier

- Core or value-add

- 6.5% - 9.0% cap rate

- Land

- Zoned for multi-family, single-family, or mixed-use

- Parcel(s) over 2 acres (unless infill)

- Ground-Lease

- Leased Fee

- Any product type (i.e., industrial, office, retail, etc.)

- Ideally priced at or under land value with substantial improvements on the land

INVESTMENT PARAMETERS

- $1 Million to $15 Million per transaction

- High traffic count - over 50,000 VPD

- ± 200,000 population within 5-mile radius

- ± $50,000 average household income within 3-mile radius

- Rent to sales below 8% for tenants that report

- Stabilized property or properties with vacancy, rollover, or lease-up risk

- Property that can be re-entitled for higher and better use

- Distressed debt opportunities

- Infill locations that have a presence near freeway(s) and/or primary airport(s)

- Strong emphasis on underlying basis - below replacement cost

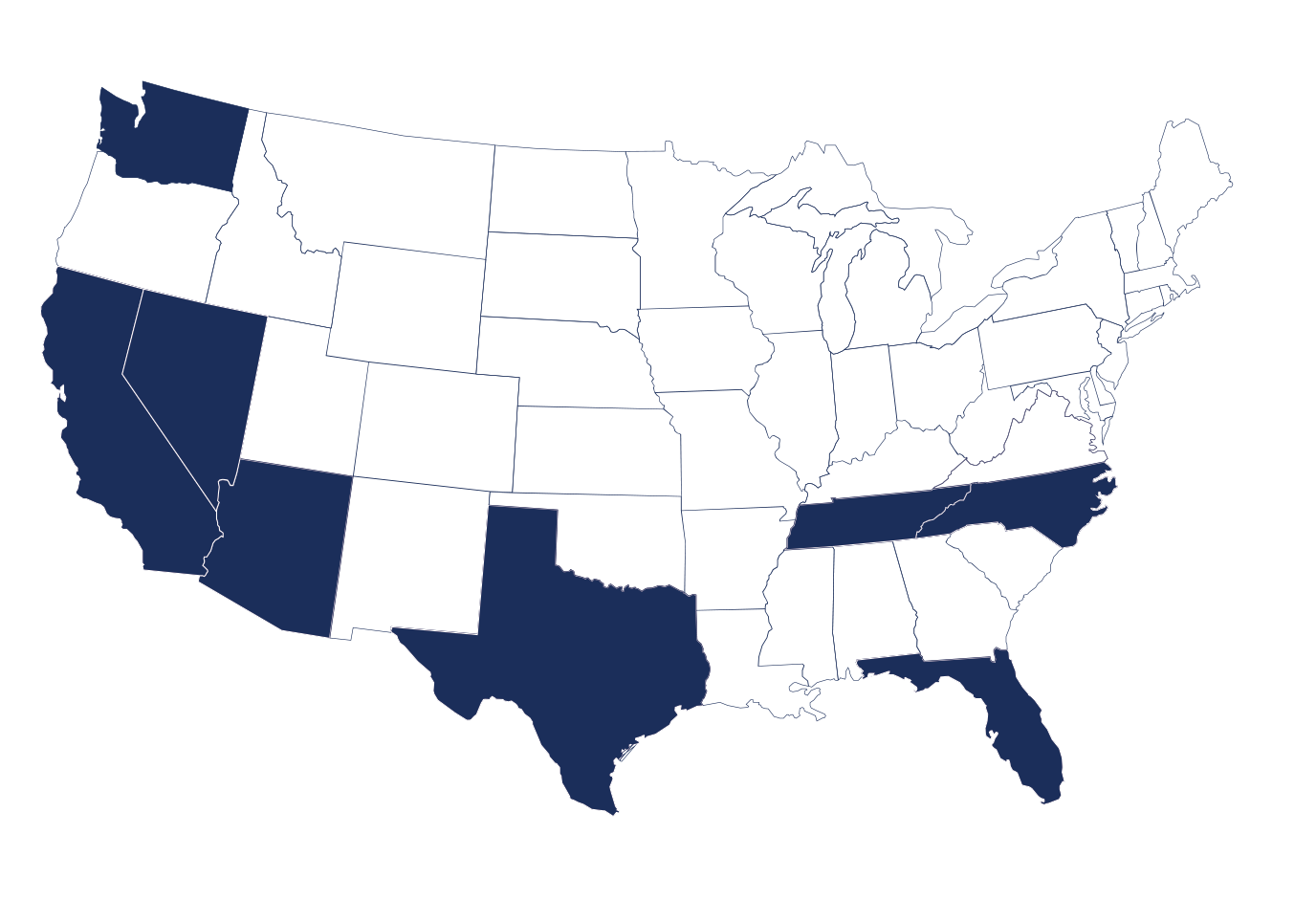

TARGET MARKETS

- Arizona, California (southern & select areas in central and northern), Florida, Nevada, Tennessee, Texas, North Carolina, & Washington